On 28 April 2014, the U.S. launched its third round of sanctions on Russia, aimed at President Vladimir Putin’s cronies and their businesses. As the situation continues to deteriorate, investors in and out of Russia face bigger risks.

Although their confidence has not been entirely crushed, investors are leaving Russia for safety measures. Russia saw a $64 billion net capital outflow in the first three months of 2014 and is expecting a total capital outflow worth $150 billion this year. Previously, GRI’s analysts Luke Rodeheffer and Sean Durns have looked into the economic ramifications of the Crimea crisis and capital outflows from the region. Yet recent developments of the crisis may add more weigh to investors’ backs.

On 28 April 2014, the U.S. imposed further sanctions on Russia, and accused Moscow of escalating the crisis and ignoring the Geneva accord. Specifically, seven Russian oligarchs would now face U.S. visa bans and asset freezes, and 17 companies linked to Putin’s inner circle would have their assets frozen.

Among them, one particular figure stands out: Igor Sechin, head of the oil tycoon Rosneft. Although sanctions on Mr. Sechin himself would not confine Rosneft’s dealings with western counterparts, as Sechin controls less than half of the company, foreign direct investment related with Rosneft is now exposed to higher risks.

BP, the British oil company, has close to 20 percent equity stakes in Rosneft, while ExxonMobil, Statoil and ENI – three oil giants – have all signed partnership agreements with Rosneft on oil exploration projects in Siberia and the Arctic. BP’s investment in Rosneft contains a third of BP’s production volume globally and 13% of its net income.

The market, however, reacted to the escalation of sanctions with almost an iron nerve. The stock prices for Rosneft tumbled on 28 April, but recovered soon afterwards. The market did not penalize BP and ExxonMobil for investing heavily in Russia as much. Despite minor slumps in March, the two companies’ market capitalizations are faring well at the moment.

Indeed, given the fact that Rosneft itself was not targeted by the U.S., some were even mildly optimistic about the prospects of foreign direct investment (FDI) in Russia’s energy sector: Royal Dutch Shell, for example, is planning to ramp up investments in energy projects in Russia.

Nevertheless, the market’s calm reaction to heightened risks does not mean the de facto risks are not higher. One should note that some investors’ decisions not to give up on Russia may be due to threats from the Russian government. If foreign investors sever their investment agreements with Russia, they may not be allowed by the Russian government to re-enter the market again in the near future.

Moreover, even though BP and the other Western companies can still carry on with their projects in Russia together with Rosneft, Rosneft’s mounting debts burden, thanks to the weakening ruble, now seems like a time bomb.

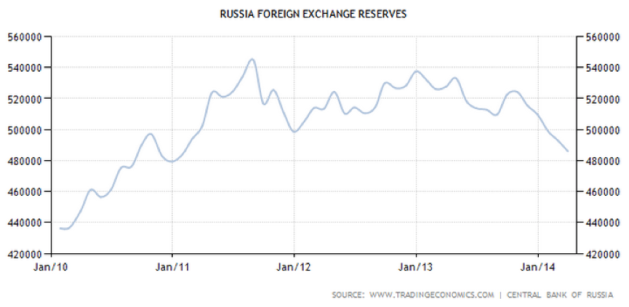

Rosneft has $52 billion of debt, mostly in foreign currencies. Although Russia has enough foreign reserves to support its currency for a few of years should the capital outflow continue (see the chart below for proofs), a surely weakening economy is no good news for FDI in Russia.

Worse still, the crisis in Ukraine is remotely situated. Putin seems determined to bear economic hardship in return for his ambitions in the West, while the U.S. seems unwilling to extend more diplomatic resources to the region.

Without the complications experienced by foreign direct investors in Russia, short-term capital fled Russia a while ago. For instance, over $1 billion had been withdrawn from emerging Europe equity funds in the first three months of 2014.

For opportunists who attempt to benefit from the already weakened Russian equity market, it may not be the safest time to make the move.