Trade imbalances put the Dollar at risk, at state of affairs that is overdue for a correction, as China matures and the U.S reins in consumption.

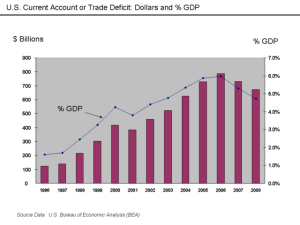

Perhaps the most fundamental feature of today’s international economic order is the massive trade imbalances between the United States and surplus countries. The 2012 U.S. trade deficit stood at nearly $540 billion. Surplus countries consist of oil exporters like Saudi Arabia (252b), export powerhouse Germany (219b), and East Asian countries such as China (155b), Malaysia (39b), South Korea (30b). Some experts such as Michael Dooley and Ben Bernanke believe the current system is sustainable for at least another decade due to the high savings rate in East Asia and their continued desire for export-led growth. However, most analysts see an impending correction in the short term.

There is debate over how this correction will look and who will pay the most for the adjustments. China will need to switch towards more consumption led growth, which has the potential for reducing jobs in the export industry and could be politically perilous. Europe needs to engage in long overdue structural reforms, particularly in the labor markets, and the United States will need to start living within its means and exporting more. Eichengreen and Park estimate this means reducing the U.S. budget deficit to 3% of GDP and depreciating the dollar by 20%.

How quickly this transition happens is critical. It is much easier to stop importing than it is to start exporting. Exporting more involves building factories, finding a network of buyers, and signing contracts. Importing less involves spending fewer dollars at the super market. This means the faster the adjustment takes place the more likely it is to come out of the import side of the equation. The trade deficit in the U.S. is currently 3% of GDP, so an adjustment that took place overnight (during a brief, but intense economic crisis) and returned the U.S. to trade balance would imply a contraction of at least 3% of GDP.

The costs of such a sharp adjustment would be felt not only in the U.S. but also in surplus countries in East Asia and the Middle East. Such a reduction in U.S. imports would translate directly to a loss of jobs in developing countries, particularly in the manufacturing sector. A disorderly adjustment is in nobody’s interest. But that does not mean it will not happen.

No country wants to trigger such an adjustment by halting purchases of U.S. debt or dumping treasury bills on the open market. However, no country wants to be the last one to react to an emerging crisis. An overnight adjustment would likely involve a massive depreciation of the dollar, which means any holder of dollar denominated assets would take a large loss when they seek to convert their dollars back into their domestic currency. This raises the incentive for countries to dump their dollar assets and could lead to a dollar crisis as each nation sought to get out before the dollar dropped further. China and Japan both hold over $1.1 trillion in U.S. debt meaning a 20% decline in their asset value (as estimated by Eichengreen and Park) would be a serious chunk of change. Such a disorderly adjustment would be disastrous for the world economy and should give policy makers an incentive to undertake needed economic reforms before the crisis truly reaches a head.

A saving grace in this situation might be the lack of a plausible alternative to the current arrangement. As I wrote two weeks ago there is no obvious alternative to the dollar as the world reserve currency, particularly with the Euro-zone in such a state of crisis. Asian countries might also be willing to live with the negative effects of maintaining a peg to the dollar even if it were in free fall. Again, this is primarily due to the lack of clear alternative export market. However, the incentive for a small or medium size nation to cheat the system might be too great. Such a country would realize that they could get away with selling their dollars without provoking a crisis so long as other nations did not follow suit. It is a classic prisoners dilemma where the best outcome for each party is to defect while the others continue to cooperate. Yet even a smaller country like Thailand or the Philippines could trigger a crisis by raising fears among neighboring nations and igniting a herd mentality.

Thus, investors and policy makers alike should closely monitor the debt purchasing decisions of foreign countries. Avoiding a run on the dollar is not impossible, but the longer such large trade imbalances remain the more likely it will become.