Global defense spending is set to rise for the first time since 2009, as Middle Eastern and Asian-Pacific nations invest more heavily in their militaries. US contractors, squeezed by tight budgets at home, are looking to capitalize on the growing international market.

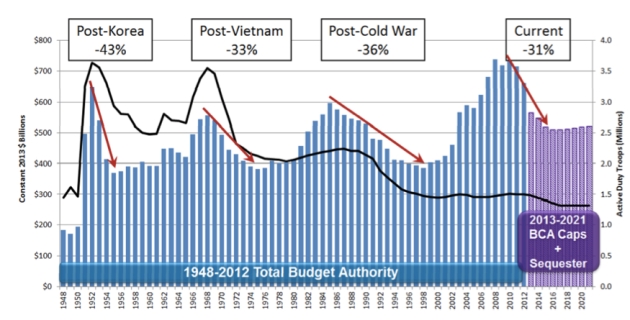

As the United States continues to fight a seemingly never-ending partisan battle over its budget, debt, and deficit, annual outlays to military and defense programs have seen consistent stagnation and decline. Budget caps coupled with the winding down of engagements in Iraq and Afghanistan are likely to cut the Pentagon’s spending by about $1 trillion over the next decade.

The US has seen its largest defense spend decline since the Cold War (Source: CSIS).

While US military spending still far outweighs many other nations’ budgets combined, defense and aerospace contractors are looking to diversify their revenues by seeking business internationally. Global defense spending is set to increase for the first time since 2009 as markets in the Middle East and Asia ramp up spending, according to a study by IHS Jane’s.

Four of the five fastest-growing defense markets are in the Middle East, where Saudi Arabia has more than tripled its military budget over the past ten years. Asian countries have also seen their defense spending rise, where South Asian nations seek to counter the threat of rising military prowess in China. China has steadily increased its budget by 10% a year, propelling its 2013 military outlay to $139.2 billion.

Defense contractors push internationally

Defense contractors see a unique opportunity to capitalize upon increased military spending in emerging markets. According to Avascent, a defense consulting firm, the Asian defense market alone is worth upwards of $350 billion over the next five years. This is just the type of foreign growth US defense firms are looking for as budgets continue to tighten at home.

The largest air show in the Asia-Pacific was held earlier this month in Singapore, where US defense contractors marketed their products alongside European and Asian competitors. Among the firms in attendance were Boeing, Lockheed Martin, Raytheon, and General Dynamics.

“We are going through some difficult budgetary times right now with the U.S. defense budget and foreign sales are important to maintaining and sustaining the strength of our industry,” said Pentagon procurement chief Frank Kendall. While exports are key to improving defense firms’ bottom lines, they also help keep costs down domestically. Boosting exports increases production volume, helping to reduce production costs and increase efficiencies.

Contractors face challenges, yet high rewards

Making the international shift has proven challenging for many contractors, who are simultaneously cutting their workforces and increasing their international presence.

Lockheed has cut 30,000 jobs in the past five years to increase efficiencies and cut operating expenses. They’ve also recently created an international unit, with dual headquarters in London and Washington, and regional offices in the Middle East and Asia-Pacific.

Overseas business accounted for roughly 17% of Lockheed’s $47 billion in sales last year, a figure CEO Marilyn Hewson believes they can boost to 20% over the next two years. This figure is still far behind Lockheed’s biggest international competitor, Raytheon Co., which derived close to 30% of its revenue from international sales.

Though international contracts are increasing in importance, they are also prone to delays and unanticipated challenges. While the contractor is ultimately responsible for the production and facilitation of products sold internationally, the government negotiates the deal on the contractor’s behalf. This sometimes results in unrealistic deadlines, or guarantees of capabilities or technologies outside the contractor’s scope of expertise.

While challenges remain, markets are already responding to defense firms’ push abroad. Lockheed Martin’s stock has climbed some 50% since fall last year, peaking at $163 per share in February. Raytheon has seen its shares almost double in value over the past year.

The rise of these firms is a positive sign for investors, as well. As governments in the Middle East and Asia-Pacific continue to invest in their militaries and security infrastructures, the value of Western defense and aerospace firms are likely to continue their unprecedented climb.