The digital currency could push China into making tough decisions about liberalizing its financial system.

Although Bitcoin is designed to be a decentralized currency that can be used the world over, China is quickly becoming the center of focus for its future. Once a non-player in trading Bitcoin, China is now home to the largest Bitcoin exchange in the world, BTC China, and about one-half of the world’s daily turnover of the currency. Even Baidu, the Chinese equivalent of Google, now accepts payments in Bitcoin.

Bitcoin’s recent success in China shows the perfect match the two are. Bitcoin, which was invented in 2011 to be an anonymous and unregulated currency for use on the internet, allows owners to purchase goods without tracking and – more importantly for Chinese residents – freely and quickly move money across international borders.

Although the Chinese government has been on a slow and steady path towards liberalizing and opening its financial system, moving money out of the country still poses a challenge for Chinese individuals. This is just one of the consequences of the China Foreign Exchange Trade System’s (CFETS) tight controls on its exchange rate: Free flows of renminbi in the world market (especially flowing out from China) would make the task of holding its exchange rate artificially low infinitely more difficult.

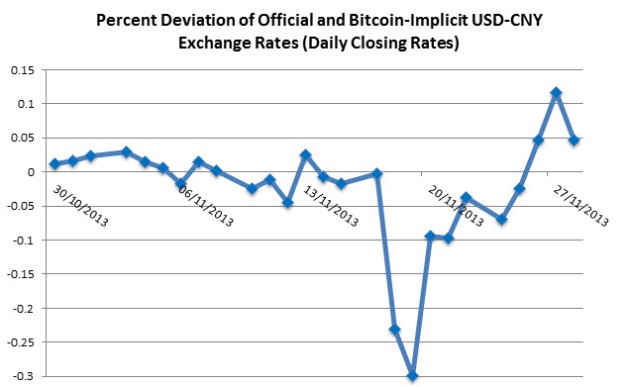

The rising profile of Bitcoin has allowed more Chinese citizens to skirt this system to invest in international assets. In fact, the implicit exchange rate between the U.S. dollar and renminbi using Bitcoin as an intermediary has recently shown that the renminbi is stronger against the U.S. dollar than the official exchange rate.

Data source: Bloomberg, MtGox, BTC China. (The major drop on November 18 is due to a rally in the U.S. market after a positive U.S. Senate hearing on Bitcoin)

How will Beijing react to Bitcoin?

Chinese citizens’ intense interest in Bitcoin creates a tricky situation for a Chinese government that has been slowly liberalizing its financial system over the last decade. To this point, Beijing has largely been silent on the issue, although that silence in itself could be significant. Looking forward, there are a few possible routes of action for Beijing.

If history is a guide, China could be about to crack down on Bitcoin, just like it did on the digital currency QQ in 2009. Even though Beijing is moving towards a freer financial system, it is doing so in a measured and careful manner. Shutting down Bitcoin in China would show that the government is uncomfortable with the fast and unconstrained capital movements that Bitcoin enables.

Actions to shut down Bitcoin in China would force Chinese holders of Bitcoin to liquidate their holdings, or else continue trading illicitly. The value of the Bitcoin would also tumble, since so much of the currency’s demand comes from China. Even though Bitcoin has survived tremendous volatility in the past, cutting off the Chinese market could doom the currency.

But China’s attitude towards the financial system is different in 2013 than it was in 2009, as shown by its recent statements on reform. Beijing could let Bitcoin continue to be traded freely. In this case, Chinese citizens would have much less trouble moving their money out of the country to purchase international goods and assets.

If Bitcoin in China continues to be characterized as an unregulated and inexpensive way to move cash abroad, the entire Bitcoin currency will cease to be useful to purchase goods, which was its original intent. The unique design of the Bitcoin allows for only a slow and declining increase in the monetary base, until the total number of Bitcoins reaches 21 million (there are about 12 million today), at which point it can never grow further. If demand seriously outstrips supply, Bitcoin will quickly become nothing more than a financial tool to move money internationally. The intense deflation built into the system will destroy its usefulness as a medium of exchange.

Limited Tolerance

The more likely scenario is that Beijing will tolerate Bitcoin. It will allow its citizens to continue using the digital currency, if nothing else as a token to appease those unhappy with slow reform. Bitcoin still is only being purchased by very few Chinese citizens, so there is no mass risk to government policies by letting it continue to operate. Indeed, all signs so far point towards this implicit tolerance of Bitcoin. In its limited reporting, Chinese state media has been largely positive on the currency. It is also unlikely that a behemoth like Baidu would have started accepting payments in Bitcoin without at least consulting the government and CFETS.

The risk, however, is if Bitcoin gains enough popularity and public interest to undermine the reform scheme that Beijing has been carefully implementing for over a decade. In that case, Bitcoin could be too big for its own good and could be pushed out of China for that reason alone. However, if China proceeds, Bitcoin will be the newest and most exciting storyline in financial journalism for the foreseeable future.