Yellen’s first statements chart clear path for Federal Reserve

The new Fed Chairwoman made clear to Congress that her Fed will focus on improving the labor market and being straightforward in its messaging.

In her first major appearance since becoming the new Chairwoman of the Federal Reserve, Janet Yellen spent last Tuesday answering questions from the House Financial Services Committee. Although she had made abundantly clear for months that her approach would follow closely to that of her predecessor Ben Bernanke, Yellen used her testimony to send a strong message about her philosophy and the course the Fed will take in her first year.

From the beginning of the hearing, when she was asked if she was a sensible central banker, Yellen reinforced a firm and measured approach to her position. This is not surprising, given she has served as the Vice Chairwoman of the Fed for the last four years and has no doubt learned from the stumbles Ben Bernanke made when he first took the role. Her other responses throughout the day gave three clear indicators of what’s ahead for the Fed:

Straightforward, clear communication

Both of Yellen’s predecessors were infamous for their veiled and imprecise language. Former Chairman Alan Greenspan, for example, would only call the forming dot-com bubble “irrational exuberance.” Based on Yellen’s testimony and Congress’s reaction, she will not follow in his footsteps. Republican Representative Shelley Moore Capito thanked Yellen, saying, “I’ve understood more of what you’ve said today than I have of the last two folks who were in front of us.” That is exactly what Yellen wants.

The Fed’s reliance on forward guidance, a messy but ultimately effective tool used by central banks that have already used all their other policy tools, requires that markets trust the Fed’s interest rate forecasts (and that the bank will be credibly irresponsible). As markets start wondering when rates will rise, clear messaging becomes even more important.

Yellen is stepping into her role as Chairwoman leading the charge with a clear message: rates are going to remain low for a long time. Among her other strongest messages is that based on information currently available, the taper will continue at its current rate. December and January’s mediocre job growth will not affect it, unless the coming months’ reports show that this trend is more than just a two-month aberration.

She succeeded, and US markets loved it, with the S&P 500 rose 1.1%. Even emerging markets loved it: Hang Seng rose 1.5%, and Ibovespa rose 1.6%.

Focus on broader measures of the labor market

The Fed is tasked with a dual mandate of keeping inflation low and employment high. Throughout the recovery from the financial crisis, Yellen has been a strong advocate of more actively addressing the employment mandate – especially with historically low inflation.

With inflation at historically low levels, Yellen is firmly focused on the Fed’s full employment mandate. (Source: Federal Reserve Economic Data)

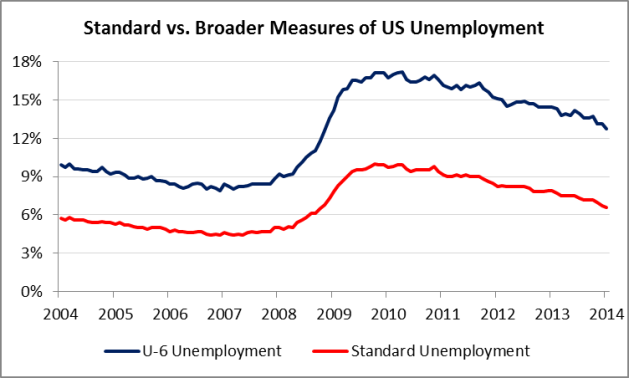

Separate from its quantitative easing policy, the Fed has set out forward guidance about future interest rates since 2012. At that point the Fed announced it would keep rates near 0% until well past the point when unemployment hits 6.5%. With unemployment closing in on the threshold level, markets are wondering when the rate hike will begin. To ease this anxiety, Yellen called attention to more robust indicators of labor market health in her testimony. In particular, she noted that broader measures of unemployment are still weak and long-term unemployment is too high.

Instead of solely focusing on the standard unemployment rate, markets will be smart to focus on the broader range of indicators Yellen mentioned in anticipating the Fed’s future moves.

U-6 Unemployment, which measures unemployed persons as well as discouraged and underemployed workers, will be a point of focus for Yellen. (Source: Federal Reserve Economic Data)

U-6 unemployment not only measures the standard unemployment rate, but adds underemployed workers and discouraged unemployed persons. With job finding rates lower than the historical trend, the broader unemployment rate remains high – nearly double the standard rate.

Another focus will be the declining labor force participation rate among the working age population. This shows a similar story: long-term unemployed and discouraged Americans are simply giving up their job search, which is not reflected in the standard unemployment rate.

The proportion of Americans aged 25-54 who are in the labor force has steadily declined since the financial crisis. (Source: Federal Reserve Economic Data)

Once the 6.5% unemployment threshold is reached, these indicators will provide the markets guidance as to when the Fed will begin considering a rate hike. This will be considerably easier to follow especially compared to the Bank of England’s tactic of targeting a smaller output gap, which is much harder for markets to measure.

Emerging markets outside fed mandate

After the retreat of capital from emerging markets in the last month, much of the blame fell to the Fed’s decision to taper its long-term asset purchases. With the South African Finance Minister and others denouncing the Fed’s recent actions, world markets were waiting to hear if Yellen would make a comment on emerging markets.

Yellen was firm in asserting that the Fed’s mandate only extended to ensure that the US economy was strong, and that it would only change course based on changing conditions within the US. In other words, as long as the emerging markets sell-off doesn’t hit the US, the Fed would not be addressing it.

Although this is not the answer many in the international community wanted to hear, it is reassuring in some sense. With many factions in the US already concerned about the power of the Fed, adding mandates could be seen as a precedent for future regulatory creep. Unless it comes to affect US markets, the Fed will leave capital outflows from emerging markets to be stabilized by those markets themselves.