Despite discouraging news towards the end of 2013, the prospects for the Australian economy are strong for 2014. However, dependence on continued Chinese growth and a potential housing bubble may dim the light ahead.

2013 was a tough year for the Australian economy as GDP only grew by about 2.3 percent. While leaders in the US and Europe dream of such growth rates, those in Australia cannot help but be disappointed.

After twenty-plus years without a recession, fueled by a booming export business in iron ore and coal, the world’s tenth richest country finally showed some fatigue. Not only was growth down, but unemployment hit 5.8 percent in November and the deficit was forecasted to be larger than expected in December.

2014, however, projects to be a much more robust year down under, even by Australians’ own high bar. Iron ore and coal, which have been the building blocks for China’s rapid expansion over the last decade, once again look like they will be strong. On top of that, the sharp depreciation of the Australian dollar and lower interest rates will help non-mineral industries.

Happily helping China boom

Australia is the world’s largest exporter of iron ore, and there is no need to guess where the lion’s share of it is going: China. Of all Australia’s exports, including its other main resource coal, 35 percent go to China alone. The constantly growing demand for fuel and building supplies from East Asia is at the core of Australia’s robust and prolonged growth.

When the financial crisis crippled the economies of other OECD countries, Australia exported its way around a recession. To see just how much China’s growth is fueling Australia’s, just look at the correlation between China’s growth and Australia’s exports:

With a short lag, peaks and troughs in Australia’s exports follow China’s GDP growth (Source: Federal Reserve Economic Research)

Not surprisingly, when China’s growth picks up, Australia’s exports surge soon after. It is fair to say that without its close proximity to China and China’s rapid development, Australia would not have been able to sustain its recession-busting growth.

If 2014 is going to be good for Australia, its mineral exports will have to be strong, and that is just what Australia’s Bureau of Resources and Energy Economics is forecasting. In December, it revised its forecasts for exports of coal and iron ore up by nearly 6 percentage points. The new figure represents a 23 percent year-on-year increase.

But with so much of its growth tied to one country, there are obvious risks, which are heightened by an increasing wariness over the Chinese economy. If the Chinese construction boom slows, Australia will be hit hard. When the Chinese economy slowed in 2009, as in the above chart, Australian exports suffered. Any prolonged slowdown will put Australia in a place it may have forgotten how to deal with: a recession.

Of course, any discussion of Chinese growth would not be complete without a disclaimer: we are not sure if the data is reliable. Many forecasters and commentators have figured out ways around questionable data, and their estimates reveal that indeed a slowdown has arrived in China. A technical recession may have arrived already, and retail sales are slowing as well. But because there is so much opportunity to grow in China, there is inertia for its energy use and construction. Despite fears of slowing down, China’s appetite for Australia’s exports is still voracious.

Depreciating Australian dollar increases competitiveness

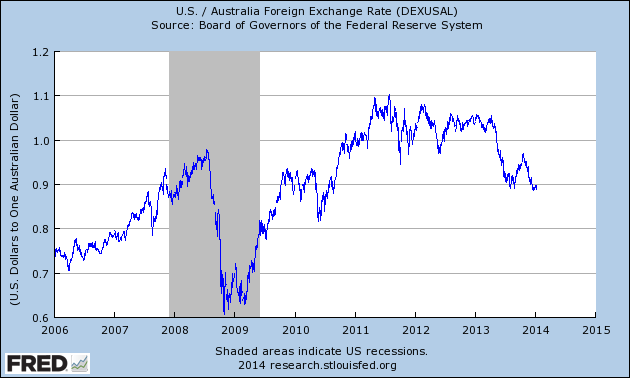

Between 2009 and 2011, the Australian dollar appreciated 40 percent against the US dollar. While that may not have significantly slowed down Chinese demand for its iron ore and coal, it hurt the parts of the Australian economy that are not connected to mining.

After sustaining 25-year highs against the US Dollar since 2010, the Australian Dollar has depreciated significantly in recent months (Source: Federal Reserve Economic Research)

Faced with an appreciating dollar and questions about the health of the economy, the Reserve Bank of Australia lowered interest rates to 2.5 percent in August 2013. The effects of the move are just now beginning to show up in the markets, but so far in 2014 surveys of business activities have been much more optimistic.

The industry that has perhaps seen the largest gains from lower rates so far is housing. New mortgage values rose by 15 percent in 2013. Like many places, residential property has become a high-return investment. But after seeing the housing crisis end the Great Moderation in the US, worries of a bubble are becoming more frequent.

These fears may be misplaced (or may be part of the bubble in articles about potential bubbles), according to Glenn Stevens, Governor of the Reserve Bank of Australia. In his December Monetary Policy Statement, he asserts that the growth in mortgage demand is not exceeding a healthy rate and that investors’ interest in housing is more a product of shifting portfolios away from other poorly performing assets.

Concerns about Australia’s economic performance may be heightened after a string of mediocre news in the last half of 2013, but the Australian economy is positioned to perform well in 2014 – and not just by the standards of the northern hemisphere’s stagnating developed economies, but by the increasingly high standards of Australia as well. There are risks, particularly if China slows or the housing market teeters, but 2014 still looks to be strong compared to other developed economies.