Guest blogger Christopher Jackson argues that the U.S. will not achieve an export boost from shale gas, as domestic demand is rising faster than production. Christopher is an expert on energy and maritime issues and is a consultant based in London, England.

Foreign Policy’s latest article on how shale gas will transform the U.S. into The United Petrostates of America requires a critical look on several fronts.

Firstly, the advent of U.S. shale will not lead to massive exports of oil and gas from the U.S. because other domestic energy sources (coal, oil and natural gas) are declining and because emerging markets like China, India and Brazil have a plethora of other less politically sensitive sources of petroleum products they can access.

Secondly, the U.S. petroleum industry primarily exists to service the production of U.S. goods for American consumers, whether that is for transit needs (in a vast territory with poor public transport) or heavy industry like chemical manufacturing, shipbuilding, car building. The U.S. will not export what it needs at home and so will not get the boost in its trade with other states.

Lastly, the assertion that export of shale produce is not the reason why the U.S. dollar is strong against other currencies does not hold. Rather, the dollar is relatively strong because it is the world’s reserve currency. In times of uncertainty, people invest in dollars because of the long held belief that Washington will not default on its debts. Excluding those who wishfully write about U.S. decline and effective credit-ratings agencies, people trust the U.S. to pay and are almost blind to any other considerations. See for instance the decline in U.S. ten-year bond yields, when the U.S. had its Triple A rating cut for the first time.

In addition, $9 trillion of the $14 trillion U.S. national debt is in fact held in government bonds by U.S. citizens and foreign investors. The incentive to default on citizens and institutions of the state itself is non-existent.

All of these things combine to a simple question that seems to be missed in the U.S. discussions of shale gas: What is the U.S. net increase in energy supplies?

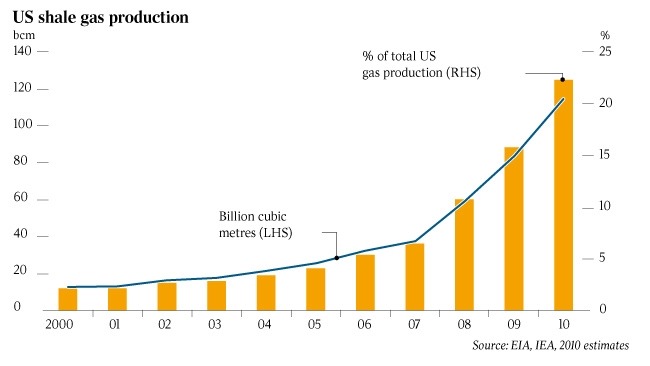

If we look at the historic growth in American natural gas over a twenty year period, we see domestic natural gas consumption rose from 19.17 trillion cubic feet (Tcf) in 1990 to 24.09 Tcf in 2010 – a demand increase of 25%. Yet over the same period U.S. production of natural gas only grew at 21% (17.81 to 21.58 Tcf). To add to this, the growth in U.S. gas supply between 2012 and 2032 is predicted to increase at an even slower level of 15% over the whole period.

Thus the key point is that U.S. shale gas is not a bonus to U.S. energy supplies, rather it is the critical lifeline preventing collapse. According to the U.S. Energy Information Administration, over the next twenty years the U.S. is expected to increase its supply of gas from 23.65 Tcf to 27.27 Tcf from all sources. But if the growth in gas demand increases by the same factor as between 1990 and 2010, then there will be a net deficit.