GRI talks agribusiness and commodities with Karl-Axel Lindgren of City University London. Come take a look at food futures and investing in the industry.

Commodity trading has been a hit in recent years, with prices going up and up in the face of increased and rising demand from emerging economies, most notably China and India. That fact that harvests worldwide have been historically poor does not hurt the price performance either. America experienced the worst drought in 50 years, Russia and Ukraine saw disappointing yields too, and Britain’s crops were left longing for warmth and summer, just like the Brits themselves. Furthermore, the rise in biofuels add to the list of uses for agricommodities. Previously, investing in food has been the prerogative of large enterprises, and thus unavailable to small investors, but investment houses and funds have been setting up vehicles to allow the latter to join. It is quite illustrative of the popularity of food commodities to note that Schroder’s Alternative Solutions Agricultural Commodities fund had to close its doors to new investors just 17 months after launch, due to over-subscription in combination with Schroder’s philosophy that investors are served better by keeping it small.

While some commodities, such as iron ore and coal, carry some risk, primarily due to the slowdown of growth and investment in China, food is inelastically supplied to hungry mouths worldwide and is determined largely by population growth alone, which is forecast to increase up to 9.2 bn until 2050. The focus is shifting from low-cost food commodities to more premium foods, such as meat, but demand for corn, soy and grains is not likely to wane for this reason alone, seeing as these enter the food chain as feed for animals. It is pretty straight-forward; producing 1 kg of beef requires 3.5 kg of grain, and 1 kg of pork takes 2 kg of grain, so as people in developing economies demand more protein in their diets, demand for all food commodities will increase, possible even with a multiplier effect for grains.

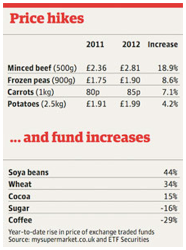

It is this obviously lucrative trend that has attracted so many smaller investors, and facilitated the creation of Exchange Traded Funds (ETFs) based on agricommodities, which track the price of individual commodities, and where minimum investments are as low as £2. Speculation in food has received a lot of bad press to such an extent that European banks withdrew vehicles allowing investors to speculate in food in August last year. The info box here states the point nicely, although without determining any causal link.

Granted, investors ought to think about the ethical aspects of using food as a vehicle for investment. Opinions differ on the topic of whether speculation facilitates greater efficiency and capital investment in food production, or whether it simply adds to price volatility, notably by putting upwards pressure on these. The former attitude rests on the argument that exchange traded commodities (ETCs) entail reduced cost of capital for firms in the food sector, making them more likely to invest. According to James Govan, manager of the £132m Baring Global Agriculture fund: “The things we are investing in are about expanding food supply, such as fertilisers, drought-resistant seed, irrigation equipment and so on.” The latter claims that food speculation pushes up real prices of food and exacerbates hunger in the poorest parts of the world, as well as making the daily bread significantly more expensive for the Western consumer. It may well be that it is near impossible to detangle the adverse effects on food prices stemming from rising demand and problematic climate change and those that might originate from speculation.

The International Monetary Fund and the Food and Agriculture Organisation have published studies indicating that supply and demand, rather than speculation, were behind rising prices, and undeniably, several factors unrelated to the stock market have put upwards pressure on demand, and thus prices, globally. Apart from increasing global population, fewer people focusing on farming and going to other industries, and potential global warming, there is also the world’s governments trying to flood the world with paper money to generate the illusion of growth, adding volatility to the situation. However, no one should expect any less than forceful defense from people profiting from agricommodities. That said, as of 2012, despite the rise in global food prices, the agricultural funds showed pretty weak performance. Baring’s fund is up just 4.6% from 2011 to 2012, Sarasin 9.7%, First State 6.2% and Allianz 3.6%. Eclectica’s fund fell 2%. In contrast, the average fund in the UK All Companies sector grew about 16% from 2011 to 2012. The trend charts show overall long term growth, but also volatility, as expected:

To explore these issues further, I had the privilege of interviewing MSc Food Policy student Karl-Axel Lindgren (City University London).

Q. How will demand for food pan out in the coming years?

A. As our global population increases, overall demand for food will increase as well. We will be up to 9 billion by 2050, and if you couple this with increasing urbanisation of the population (70% urban by 2050, as opposed to 40% now), as well as increasing income levels we are looking at a situation of a future population that will be larger, more urban, and richer. Trends have shown that as nations become more well-off, demand for a Western diet increases; highly processed foods that are high in animal fats and protein, refined carbohydrates, and low in fruit and vegetables. The Western diet is predicated on grains such as corn and soy, which are the main feed for cows, pigs and chickens, as well as having use in processed goods as the fillers and thickeners, appearing on the label as soy lecithin, or maltose dextrin etc. As the demand for those products increases, demand for corn and soy will increase as well. Wheat and rice have already high demand as dietary staples in much of the world, and that is set to increase as well. As a result, we are looking at an increase of 3 billion tonnes of grains by 2050, from a maximum of 2.1 billion today, as well as an increase of meat production of another 200 million tonnes, effectively doubling the amount of meat produced from today.

Q. What can be done or what is being done to meet demand for food in the future?

A. Whether the demand will be met depends on several extraneous circumstances, particularly the health of the global economy, the price of oil, the effects of climate change, and the competition for land between urban expansion, agricultural expansion and biofuels. Some governments, such as the US, the UK and China, are already taking moves towards land acquisition in developing countries to be able to feed their population. On top of that, direct investments in agriculture must increase, particularly in developing countries, which will need political support in terms of resource reallocation, as well as increased encouragement for private participants to invest. Estimates suggest that the average gross investment in agriculture in a developing country to meet demand would be $209 billion annually. 80% of production increase would have to come from increasing agricultural yields, with only 20% of the production increase coming from an expansion to new land.

On top of these, technological expertise and investment in new technology must be done, in part to combat the effects of climate change, but to also move away from the current unsustainable practices of energy-intensive monoculture. Genetic Modification will become increasingly common (though it is already ubiquitous in agriculture for animal feed) as every solution to feeding the population is explored.

Q. What is your view on the ethics of investing in food?

A. Investing in food is a necessity. Direct investments fund research and development, which has had some tremendous technological advancements in recent years, and if we are to feed a growing population, even more investment is needed. The woes of the food industry lie rather in their view that food is a commodity, and nothing more or less. By moving food from a perceived right, and something that every living being needs for its survival, to merely another commodity that can be traded on markets and speculated upon, leaves many millions of the most vulnerable exposed to the vagaries of the global market, shifts in weather patterns, and increasing energy prices. This is set to continue, however, and the biggest way to combat these issues is direct investment in the agricultural sector, particularly in technology and techniques to make it more resilient and sustainable. Speculation as it is today increases the instability of the food market and pushes global food prices up, but is only one relatively small aspect of many other factors that add to instability and high prices, though this is an admittedly debated point. There is some research that has more closely linked with food spikes with speculation, and speculation has increased tremendously in the last 5 years.

Q. How can the current practices of investment in agricommodities be improved upon?

A. Much of the demand to improve the practice is to set hard limits in how much can be speculated upon, and from memory I seem to recall the US government actually instituting limits on speculation, but I can’t find any information to back that up. Speculation will continue, and a full ban will not occur – indeed, a full ban may not even be that helpful, and may instead increase the price instability.

Q. Fidelity reckons there could be a “second green revolution” as increased fertiliser usage improves yields in Africa and Asia, and tips fertiliser companies as potentially star stocks. Do you agree?

A. Sure, there’ll be attempts to utilise alternate resources, but the costs will further increase regardless. Technological fixes cannot solve the structural issues of the food industry, such as its needs for perpetual growth which characterises the current global model. Innovation is excellent and technological advances go some way in ameliorating the negative externalities of the food industry, but does not solve them.